For a number of years now, equity portfolios have been adjusted to achieve lower scope 1 and 2 carbon emissions. Some use a Paris Aligned Benchmark, others a self-chosen reduction path. When adjusting the portfolios/benchmarks, it turned out that this was doable with a low tracking error compared to the general benchmark.

The follow-up question that should logically be asked: does the same relationship also apply to other impact goals? Intuitively, we already feel that this might not be the case. A tonne of CO2 reduction is very different from achieving more gender equality. Recently, a paper was published by Impact Cubed in which this is clearly analysed by comparing the possible improvement in impact with the risk budget that you need to implement it.

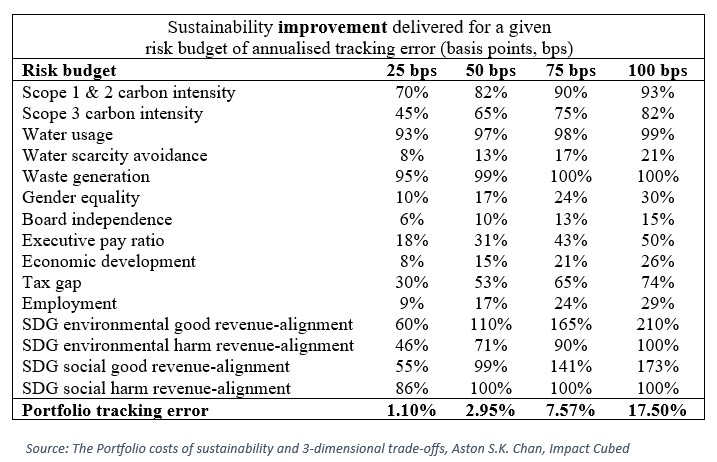

The attached table shows that for a global equity portfolio with a tracking error of 25 basis points versus the (generic) benchmark, you can achieve a 70% improvement in scope 1 & 2 carbon intensity. However, if you want to improve the avoidance of water scarcity, you can only achieve an 8% improvement with 25 basis points of tracking error. Simply put, some improvements can be achieved at relatively low ‘costs’ (with a small risk budget) and other impact improvements at relatively high ‘costs’.

The distribution per impact characteristic is also completely different and is certainly not normally distributed and is not linear in the tracking error.

Since as an investor you often don’t just have one objective, but want to pursue several goals, the question is how much diversification occurs if you pursue multiple objectives. The good news is: quite a lot! In order to achieve at least the same improvement on the 15 listed impact characteristics in the table that is achieved with 25bp tracking error, you don’t need 15 x 25 bp = 3.75% tracking error, but only 1.1% tracking error. That is a lot of diversification!

It can therefore certainly pay off to tackle the multiple impact objectives at once in order to arrive at (impact) efficient portfolios.

So, for example, suppose you are planning to create a concentrated equity portfolio and you are pursuing 3 or 4 impact objectives (e.g. in the form of SDGs), then it makes sense to include these at once. And we can also apply the restriction that other impact dimensions are as high as possible (and in any case not worse than the benchmark). And all this is possible because of the impact diversification.

…so also in impact investing diversification is the only free lunch!

PS 1: Actually, you should include a 3rd dimension with expected returns in these analyses. It turns out that with reasonable assumptions (Black-Litterman model) it is possible to keep the return expectation close to the index despite relatively substantial adjustments to the portfolio. As an example, the aforementioned 1.1% tracking error portfolio is expected to have a 1.1 bps lower return.

PS 2: The question behind the question should also be asked. Are you going for a ‘beautiful’ portfolio with excellent scores on all impact dimensions or is your goal to improve companies that may not yet have such a good score on all dimensions, but that have great potential for impact improvement due to your involvement (or their own good plans)…