The theme of biodiversity is suddenly ‘known’ – that’s great – but the investability of this important theme is still in its infancy. That said, every sector has started at some point and Impact Orange Partners wants to make an important contribution to this development.

In this summer blog, we want to give you a framework to face the challenges of this theme. We hope that insight will help you make informed investment decisions. In the coming period, we will explore the challenges in more detail in follow-up blogs. As always, any comments are welcome, this is the kick-off.

Challenge 1: Biodiversity is declining worldwide. Multiple reports (*) show that more than 50% of the global economy depends on nature. We experienced a 68% decline in the wildlife population between 1970 and 2016. More than 32GT of CO2 will be released as a result of soil degradation from intensive agriculture until 2030. Everything that lives in soil, water, air and in between is under pressure. We need to clean up our planet, restore it and deploy capital to guarantee quality of life in the future.

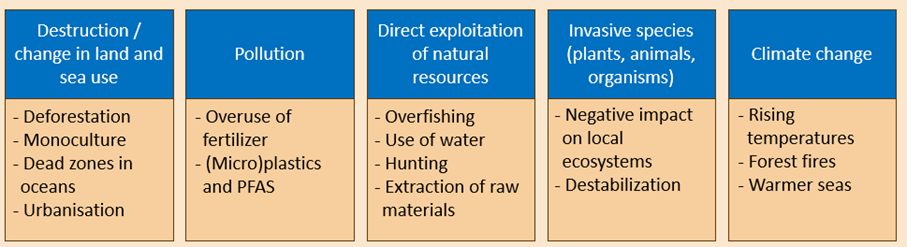

Figure 1: 5 direct causes of biodiversity loss (source: IPBES 2019)

Challenge 2: Investability and position in the portfolio. The theme of biodiversity is ‘broad’ and as a category is not yet commonplace. This makes an unambiguous investment case and place in the portfolio difficult, but not insurmountable.

The market for biodiversity products is still limited and ticket sizes are often relatively small and illiquid. On the other hand, there are high, minimum requirements from institutional investors, which can create a mismatch between supply and demand.

Similarly, it is difficult to estimate expected returns and risks of biodiversity solutions. Does this condemn biodiversity to a place outside the core portfolio? No, we are increasingly able to measure exposure to biodiversity factors, which will give the theme an integral place in the portfolio.

Ongoing research, sourcing and monitoring is a prerequisite for investability. Impact Orange Partners has put a lot of energy into research over the past 2 years. Our coverage – purely in biodiversity – is already more than 120 asset managers/funds in this area. Admittedly, a number of these funds are closed, or often too small. As a result, the most practical solution to get continuous exposure seems to be a fund-of-funds (for the time being).

Challenge 3: Impact measurement, monitoring and data scarcity. When it comes to climate change, impact frameworks are widely accepted. This is not yet the case with biodiversity and makes it difficult to compare types of impact.

By the way, what do you want to measure? More heterogeneity in animals, plants and less negative interaction with humans? Or natural CO2 storages? Cleaner land and water for restoration? Recent treaties such as the Kunming-Montreal Global Biodiversity Framework (2022), the UN High Seas Treaty (2023) and UN Plastic Treaty (2024) and the Partnership for Biodiversity Accounting Financials (PBAF) do provide guidance for measurable KPIs.

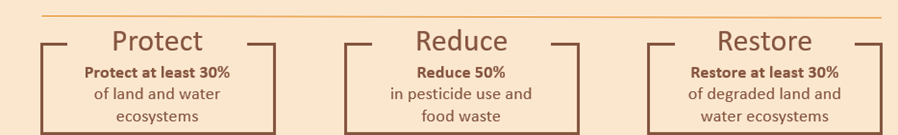

Figure 2: Main goals of the Kunming-Montreal Global Biodiversity Framework (2022)

Challenge 4: Do biodiversity and financial returns go hand in hand? Part of mitigation lies in ‘gentle restoration of land, sea, rivers and air’. This can hardly be called a business model…..until the market of ‘biodiversity and CO2’ rights really develops. There are already examples in this area: the Environment Act of 2023 states that project developers in the UK are obliged to include an investment in biodiversity conservation in their budget. For example, there are already positive solutions – especially in agri-aquatech and forestry – in which production chains and improvement of biodiversity go hand in hand. See also the following blogs in this area.

Challenge 5: Redistribution of capital to social goals. The vast majority of institutional capital allocated to impact goals is related to climate, health and combating hunger (SDGs 2,3,7, 12,13). The percentage of allocated capital to biodiversity is still very low, less than 3%. Impact goals seem to compete with each other, which is difficult to comprehend.

Challenge 6: Social, cultural and legal barriers. E.g. biodiversity investments may meet with resistance from local communities. Unclear legislation and regulations on how biodiversity should be protected can make investment cases less attractive. Biodiversity protection often requires the involvement of semi-government agencies, which can deter investors.

This was the kick-off. Follow us in the coming blogs to see how we can overcome these challenges.

*: World Economic Forum, Global Risk Report 2023 / WWF Living Planet Report 2020 / United Nations Convention to combat desertification