Introduction

The dimensions presented here stem from an article in the Journal of Business Ethics, 2022: Defining and Conceptualizing Impact Investing: Attractive Nuisance or Catalyst? First of all, it indicates that impact investing is a ‘cluster concept’.

“The particularity of a cluster concept is that even if an object exhibits fewer than all the properties, it is sufficient for the object to be regarded as an instance of the concept.”

This actually means that impact investments come in all shapes and sizes.

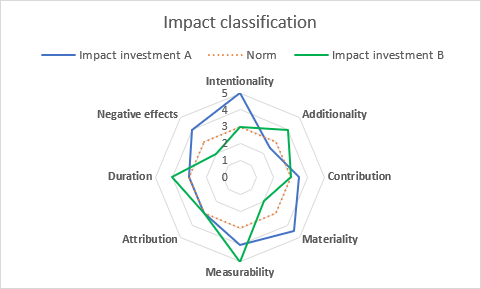

The article presents 6 dimensions (also called properties) that we have supplemented from Impact Orange Partners to 8 dimensions. The dimensions and the (ordinal) scale on which we score them are explained in the next section and the possible challenges are also indicated. It should be clear that the scoring has a subjective character. By having several people score, a more average and multidimensional opinion can be obtained. In addition to scoring, IOP recommends also recording the argumentation for the scoring.

Dimensions and scale of the concept of Impact

The different dimensions are scored on a scale ranging from ‘little’ to ‘much’. Qualifications are also linked to this. ‘Standard’ is hereby described as the starting point of the customer; this can be a basic attitude or a benchmark.

|

An example of what scoring looks like, the so-called ‘scoring spider’:

Explanation dimensions

Intentional

Has a predetermined, conscious ‘Theory of Change’ been formulated or have effects been sought? If intention is not present, you run the risk of ‘purpose washing’. There must be an intention of both impact and financial return (otherwise it is not an impact investment).

Challenge: If impact is a chance outcome, then it is not an impact investment? The current general opinion is that the investment is not an impact investment.

Additional

The amount or quantity of the impact must be greater than what would happen to ‘normal investors’ anyway. Then you often have to deal with parties that aim for lower returns or arbitrage investors who are able to spot opportunities or early stage investors with a lot of risk.

Challenge: It is difficult to prove that impact generation would otherwise not happen. Is impact created by the portfolio company (investee) additional? Is additionality transferable? Can limited partners be additional at all or do they replace other investors?

contribution

Impact Management Project’s (IMP) definition of implementing contribution: i) signaling that impact matters ii) active engagement iii) growing from new or undersupplied capital markets iv) providing flexible capital. The last two also fall under additionality.

In short: impact must be monitored and managed. This gives companies more priority for impact-oriented strategies. Active engagement can also take the form of non-financial or technical assistance for companies.

Challenge: To what extent is there signaling and engagement? How much control should you have as an investor and is this still in line with your business model?

Materiality

What counts, for whom, what must be reported and to what extent? Scoring partly depends on the vision of stakeholders; correcting for deadweight (effects that happen anyway) is necessary.

Challenge: Limits to materiality are difficult to indicate because less actual effects can also be seen as material (eg more awareness of diseases).

Measurability

To what extent is the intended impact effect (independently) measurable?

Challenge: Measuring future, slowly growing impact is often difficult. It often involves accounting for effects outside the organization (as opposed to financial indicators of investment success).

Finding a balance between ‘single and targeted’ measures or a broad indicator that is less transparent and directly identifiable is desirable. Consultation with investors is always necessary.

Attribution

To whom or what can the impact be attributed, taking into account effects that others also realize (alternative attribution). Often, idealistic investors will attribute a larger share of the impact due to the provision of capital on often less favorable financial terms.

Challenge: Does it Matter? It is about generating impact and less about who is responsible for this. Can impact be transferable anyway or does it always remain with the same initiator?

Duration

To what extent is impact temporary or long-term, one-off or continuous. Does the project require additional investment on an ongoing basis or can it exist autonomously after an initial investment.

Challenge: one does not necessarily have to be ‘worse’ than the other.

Negative effects

To what extent will negative effects arise (directly or indirectly) as a result of the impact investment? The focus with impact investing is very much on the upside. However, all investments have positive and negative impacts that must be mapped out.

Challenge: questions similar to measurability and materiality are also addressed here. It can be difficult to measure because it is outside the organization.